|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Chapter 7 Bankruptcy: Essential Insights and Guidance

Filing for Chapter 7 bankruptcy can be a crucial step for individuals seeking financial relief. This process allows debtors to discharge certain debts, offering a fresh start. Understanding the intricacies involved is key to making informed decisions.

Understanding Chapter 7 Bankruptcy

Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, involves the sale of a debtor's non-exempt assets by a trustee. The proceeds are then used to pay off creditors.

Eligibility Criteria

To qualify for Chapter 7 bankruptcy, individuals must pass the means test. This test compares your income to the median income in your state. If your income is below the median, you are eligible to file.

- Income level

- Family size

- Geographical location

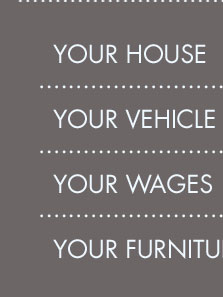

Exempt vs. Non-Exempt Assets

Exempt assets are those that you can keep even after filing for bankruptcy. These often include necessary items like clothing, household goods, and sometimes even a primary residence. Non-exempt assets, on the other hand, are subject to liquidation.

The Filing Process

- Gather necessary financial documents.

- Complete mandatory credit counseling.

- File the petition and pay the filing fee.

- Attend the 341 meeting of creditors.

- Await discharge of eligible debts.

Working with a bankruptcy attorney columbus can help streamline this process, ensuring all paperwork is accurately completed.

Impact on Credit

Filing for Chapter 7 bankruptcy will affect your credit score. However, for many, the relief from debt outweighs the temporary credit impact.

Alternatives to Chapter 7 Bankruptcy

Before deciding to file, consider alternatives such as debt consolidation, negotiation with creditors, or filing for Chapter 13 bankruptcy, which involves a repayment plan rather than liquidation.

Consulting a bankruptcy attorney conyers ga can provide personalized advice based on your financial situation.

FAQs

What debts are dischargeable under Chapter 7?

Most unsecured debts such as credit card balances, medical bills, and personal loans can be discharged. However, student loans and tax debts are typically not dischargeable.

How long does Chapter 7 bankruptcy remain on a credit report?

A Chapter 7 bankruptcy can stay on your credit report for up to 10 years from the filing date.

Can I keep my car if I file for Chapter 7?

You may be able to keep your car if it is exempt under your state's exemption laws or if you continue to make payments on a car loan.

What is the role of a bankruptcy trustee?

The bankruptcy trustee is responsible for overseeing the liquidation of non-exempt assets and distributing the proceeds to creditors.

Understanding Chapter 7 bankruptcy can empower individuals to make the best decision for their financial future. Carefully consider all options and seek professional advice when necessary.

At the conclusion of your Chapter 7 bankruptcy you will receive a discharge of debt. A discharge releases you (the debtor) from personal ...

This chapter of the Bankruptcy Code provides for "liquidation" - the sale of a debtor's nonexempt property and the distribution of the proceeds to creditors.

You will only owe debts you reaffirmed during your case. You will also be able to apply for new loans, credit cards, and vehicle loans. You may ...

![]()